How To Calculate Income Tax For Ay 2019-20 With Example

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. The tax provisions governing the Income-tax are covered in the Income-tax Act 1961.

Know The Difference Between Form 16 And 16a New Tax Route Form Tax Forms Different

We recommend to SIGN IN first before starting on this page to save data for future reference.

How to calculate income tax for ay 2019-20 with example. This calculator will help you to assess your post budget tax liabilities for the current year 2019-20 in simple steps. Total Income Rs 749600. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Income from Pension August19 to March20 Rs 149600 Rs 18700 8 Income from Interest on Fixed Deposit Rs 200000. The calculator provides an approximate figure of your income tax liability by taking into account various data such as your income. Say youve earned salary income of Rs 280000 and agricultural income of Rs 350000 during the AY.

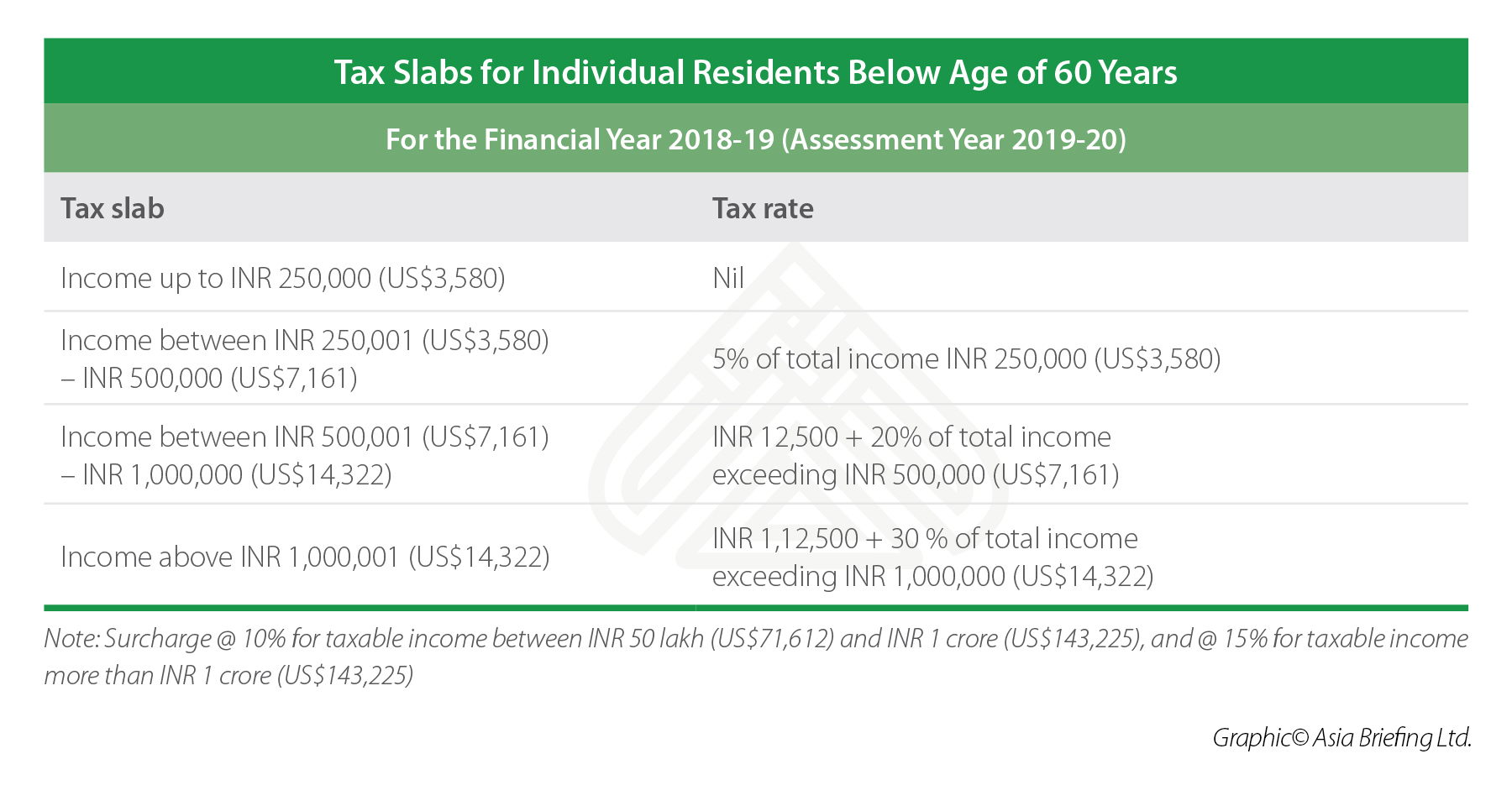

How to Calculate Income Tax on Salary with Examples for FY 2018-19 AY 2019-20. If you just started your career it is important to know your tax. This lecture covers Income Tax Rates for AY 2019-20.

Salary Pension House Property 1 SOP 2 LOP along with Set off carry forward of loss therein and. Tax on Rs 250000. Part 1 - How To Calculate Income Tax FY 2018-19 AY 2019-20 Examples FinCalC TV DOWNLOAD FinCalC Android APP.

The next step is to add all other incomes and deduct losses. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. According to Article 112 of the Indian Constitution the Union Budget of a year referred to as the annual financial statement is a statement of the estimated receipts and.

Calculate tax on total income of Rs 630000. The 201920 tax calculator provides a full payroll salary and tax calculations for the 201920 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. Income Tax Calculator for FY 2019-20 AY 2020-21.

Standard deduction of Rs. Income Tax Calculator Online for Assessment Year 2019-20. Since the above is the monthly income multiply it by 12 to calculate the yearly taxable income.

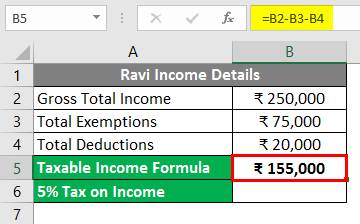

For example if you are filing taxes for FY 2018-19 the assessment year in which you will file the taxes will be AY 2019-20. Deduct the tax exemption from gross income. But you might have to pay some tax on agriculture income in certain cases.

Calculate your annual tax deduction for AY 2019-20 for investment and planning for insurance mutual funds medical insurance. Calculate income taxes online for financial year 2019-20 with online income tax calculator. 40000 has not been considered in the example.

Easy guide to file an income tax return for the FY financial year 2019-20. This calculator calculates Income from. Income Tax Calculator Online tax calculator for the financial year 2019 2020 and assessment year 2020 -21.

This is an Income Tax Calculator India for the FY 2019-20 AY 2020-21 and can be downloaded in Excel format. Financial year FY is the year for which you are filing your return while assessment year AY refers to the year in which you are filing your income tax return. Part 1 - How To Calculate Income Tax FY 2018-19 AY 2019-20 Examples FinCalC TV DOWNLOAD FinCalC Android APP.

Income Tax Calculator for FY 2019-20 AY. Tax on next Rs 250000. It is also possible to contribute to supporting this website by sharing videos and graphics that you like on this blog on your social networking accounts like Facebook and Instagram or educate.

If you want to calculate the tax liabilities for any previous years use the links provided below. We first calculate the total income for the financial year FY 2019-20 Income from Salary April to July 2019 Rs 400000. Income Tax Calculator 2020 Check your estimated Income tax for Financial Year 2019-20 based on the interim budget presented by the Finance Minister Government of India in Lok Sabha on 1st of February 2019.

For example incomes like rental income interest income and losses in trading or transacting. Know what are the calculations rates of income tax for salaried person. Income tax is levied by the Government of India on the income of every person.

Also we added the document checklist related to Personal Income tax bank real estate investment etc. How to calculate income tax on income earned in the year 2018-19Tax_RatesSlab_RatesTax_Rates_for_sen. An Income tax calculator is an online tool designed to calculate how much income tax you are liable to pay in any given financial year.

December 18 2019. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. In India every year the Finance Minister announces an annual Union Budget for the up-coming financial year.

How to calculate income tax on salary with example 2019 20 comprises one of thousands of movie collections from various sources particularly Youtube therefore we recommend this video for you to view. What Taxes shall you pay for Financial Year 2019-2020 A complete tax guide for income tax computation.

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Income Tax Preparation Tax Preparation

How To Calculate Income Tax Fy 2019 20 Examples Slab Rates Tax Rebate Ay 2020 21 Fincalc Tv Youtube

India Income Tax Calculator For Ay 2019 20 India Briefing News

80g Deduction Limit How To Calculate Deduction Limit For 80g Of It Act Income Tax Deduction Taxact

Annual Information Statement Ais New Form 26as Notified In Income Tax Statement Meant To Be Annual

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Pin By Kalasudha On Income Tax On Salary Tax Deductions Income Income Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Five Things To Expect When Attending Insurance Maternity Rider Insurance Maternity Rider H Health Insurance Plans Health Insurance Health Insurance Companies

How To Calculate Income Tax Fy 2019 20 Examples Slab Rates Tax Rebate Ay 2020 21 Fincalc Tv Youtube

Types Of Itr Forms Which Itr Form Should I Filed Income Tax Return Income Tax Tax Return

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Business Finance Research Business Finance Tax Accounting Statistics And Ana Sponsored Research Income Tax Income Tax Return Income Tax Preparation

Post a Comment for "How To Calculate Income Tax For Ay 2019-20 With Example"